Consequences of Russia cutting off the gas this winter

Even if the gas stays on, Germany should expect a harsh winter, and a worse one if it doesn’t

Short term gas shutdowns will likely lead to recession, increased risk of domestic power cuts and the possibility of escalation around Kaliningrad

On 11 July, the main pipeline carrying Russian gas to Europe, Nord Stream 1, was shut down. It had already been running at 40% capacity – because, the Russian government said, sanctions meant that vital equipment had not been returned after being sent to Germany for repair.

The shutdown was for scheduled annual maintenance, and the pipeline was reopened on 21 July. But there have been fears that Russia will do the same over winter, when gas demands are much higher, and when the economic and social consequences of such a shutdown could be vastly more serious – notably for Germany, which is heavily reliant on Russian gas.

We forecast the likely outcomes both of whether a winter shutdown would happen, and, if it does, what the results could be in terms of Germany’s ability to keep its lights on, the possibility of recession in Germany, and the chance that it could lead to NATO becoming more involved in the war.

The four key forecasts:

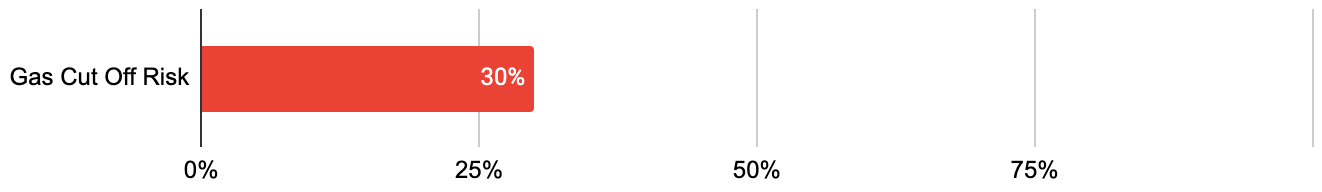

Firstly, we estimate a 30% risk of Russia cutting off gas supplies to Germany via the Nord Stream pipeline for a period of more than a week between 1 October 2022 and 1 March 2023

If such a shutdown occurs, we forecast the probability that Germany cuts power to households by more than an average of one hour per household over the same period at 22.5%

A gas shutoff will also hit growth hard: calendar-adjusted GDP would be expected to be negative for two quarters

A gas shutoff also raises our estimate of the risk of NATO or EU forces blockading ground-based travel between Russia and Kaliningrad between 1 October 2022 and 1 March 2023 from 6.5% in the event of no shutoff, to 17%

Forecasts and comment

1 Will Russia cut off gas supplies to Germany via the Nord Stream pipeline for a period of more than a week between 1 October 2022 and 1 March 2023?

(range 17% to 42%)

The forecasters felt the threat of shutdowns was of more use to Russia than an actual shutdown – although in order for a threat to be credible, there has to be some chance that it would be carried out. Russia can impose serious costs on Germany and Europe without going for a complete shutdown.

“A 40% flow rate (which can of course easily be lowered) seems easily sufficient to achieve the desired crippling effect on the German economy without entirely resorting to the full shutdown option,” wrote one.

“This is a useful stick for Russia to hold and threaten with so that NATO does not take certain actions,” wrote one. “Once they've used it, they can't threaten it anymore.” Another agreed: “I think the threat of taking it away is very useful to them. Moreso than actually inflicting the wound.”

That said, it’s a weapon with a short shelf-life. Europe and Germany are trying to pivot away from Russian gas, and may no longer be dependent upon it as soon as 2024, so if Russia were to use it, they would have to do so soon.

There would be severe negative consequences for Russia if they were to use it. “It's unclear to me that it's in Russia's interests to do this,” says one forecaster. “It will have adverse economic consequences for them and for the Ruble if they can't sell their gas.” The Russian economy also relies heavily on exports to Germany and can’t afford to “completely alienate” the German leadership. That said – and this was a theme of the last time Swift Centre looked at Russia, as well – it’s not worth betting too heavily that Russia will make rational decisions. “Putin has already proven that he makes major miscalculations,” says a forecaster.

There are two reasons why this question is hard to give solid predictions. One is empirical: the outcome is highly dependent on the course of the war – if there is significant escalation, that would increase the likelihood of shutdowns. The other is theoretical: most good forecasting looks at how often similar events happen in similar situations, to establish a “base rate”, and adjust from there. But that’s difficult here, because there haven’t been all that many similar situations. “The reference class for this kind of thing is absolutely tiny,” says one forecaster, “and it's hard to draw any firm conclusions from it.”

2 Likelihood of Germany cutting power to households by more than an average of one hour per household between 1 October 2022 and 1 March 2023

The likelihood of power outages in Germany is much greater if Russia cuts off the gas. But it’s still not the most likely outcome, according to the forecasters.

While gas represents 27% of Germany’s total energy use, it’s only about 10% of its electricity – so, assuming “cutting power” means cutting electrical power, it’s very possible that Germany could see severe energy shortages without this being especially obvious in the electrical sector specifically.

Also, it is likely that households will be the last to be affected. Industry accounts for 37% of German gas use, and two forecasters noted that there is a legal requirement – recently confirmed by the German government – that households should be protected from energy shortages as much as possible in the event of rationing. So supplies to industry would be cut before households had their energy limited.

The German energy agency, the Bundesnetzagentur (BNetzA), says that if Nord Stream continues to run at 40% capacity, and if gas use by industry is cut by 20%, then they should be able to build stores up to the point that there will not be a shortfall over winter. “Reducing gas consumption by 20% seems reasonable to me,” said one forecaster. “They've got a lot of room to reduce industrial consumption (and seem to be willing to), and gas-fired power plants can at least be partially replaced with coal and renewables.”

There are reasons other than supply levels for thinking that blackouts are unlikely. One is that the German public may be willing to make voluntary cutbacks so that mandatory ones aren’t required. “A high enough level of voluntary compliance would mitigate the need for blackouts while reducing political strife and a potential competitive disadvantage,” said one forecaster, “and Germany is a country with relatively high rates of voluntary compliance, as has been shown with recycling efforts.” Also, while the public is concerned about energy shortages, polls show that they’re even more concerned about supporting Ukraine in the war, so there may be sufficient public willingness to bear the costs.

Another is that the resolution criterion, an average of an hour per household, is “a high bar”, according to one forecaster. Even if measures like leaning on coal and renewables, running down stores, and demanding industry cut usage, are not enough to avoid some impact on households, it may not reach that bar.

Most of the forecasters agreed that while a Russian shutdown of Nord Stream could lead to German electricity rationing, it was not the likely outcome. “It's not going to be good for their economy,” wrote one, “but I doubt there will be electricity blackouts.”

3 Germany's calendar-adjusted GDP growth across 2023

Instead of giving probabilities, the forecasters gave a central estimate for growth at each quarter in 2023. Two consecutive quarters of negative growth is a recession.

This, like Q1, is a hard question to model, said the forecasters. “This sort of severe energy shock doesn't happen very often,” said one.

That meant there was quite a spread. One thought it would be catastrophic: “US GDP fell by 8.5% quarter-on-quarter in the fourth quarter of 2008, the worst quarter of the Great Recession, but naively I would expect the effects of a massive energy shock to be worse. Perhaps more akin to the Covid hit of the second quarter of 2020, where GDP fell by 33% quarter on quarter.”

Another thought that it would be severe but manageable: “If Russia cuts off gas completely between Oct 2022 and March 2023, I think that will lower the GDP by quite a bit, but not by catastrophic levels, because Germany is heavily preparing for such a scenario.”

Germany is already facing an array of severe economic stressors: “The Russia/Ukraine war, the continuing pandemic, and global supply chain issues have led the German Central Bank lowered their estimate for 2022 from 4.2% to 1.9%,” says one, while the European Commission expects German GDP growth for 2022 to be at 1.3%.

Gas rationing would only make that worse. One forecaster cites the Bundesbank predicting that an 8% contraction in the first quarter of 2023, relative to the situation without a shutdown, and even by the fourth quarter still 2% below the no-shutdown scenario.

While the legal requirement to prioritise households might prevent domestic blackouts, the impact on industry could lead to major economic impacts. “The German economy is about 18% manufacturing, which would contract under high energy costs,” writes one forecaster. “I've not been able to quickly assess what fraction of industry might become entirely uncompetitive and what fraction merely less profitable.”

One forecaster again points to the Bundesbank, which says that in industries which rely heavily on natural gas, a decline in gas inputs will lead to a proportional decline in economic outputs. In extreme scenarios, some industries could be entirely crippled: chemical plants could shut down, or tanks of molten zinc used in galvanising processes could cool and solidify, rendering them uneconomic to melt again.

The government would likely take steps to prevent the most important industries, or those which would face the irreversible destruction of capital if the supply of gas is cut off even temporarily, from facing the worst outcomes – but that would mean that a lot of “luxury” industries which provide a lot of added economic value having to close their doors. “This sort of non-market approach to reducing consumption seems likely to leave very large, sudden drops of GDP,” wrote one forecaster.

4 Risk of NATO or EU forces blockading ground-based travel between Russia and Kaliningrad between 1 October 2022 and 1 March 2023

All the forecasters thought that a Russian shutdown of Nord Stream gas made tit-for-tat blockades of goods through Lithuania to the Russian territory of Kaliningrad more likely. But once again they thought that even in the shutdown scenario, military action by NATO or EU troops would represent a major escalation, severely increasing tensions, and would therefore be the less likely outcome.

“What I've found interesting about this war is how the world has responded economically, and the acceptance of this by Russia,” wrote one forecaster, adding that they think this is the likely model for the future: “It seems much more likely to me that either harsher EU-wide sanctions would be made against Russia, or that they would try and negotiate with Russia, loosen sanctions, and receive gas again. The risks of a full blockade of critical goods and personnel seem too great.” That said, another felt that while it would represent a risk of a spiralling escalation, that risk would be relatively small, because “I don't think Russia is crazy enough to try to invade Lithuania.”

Another forecaster pointed out that the EU doesn’t have the “military might” to impose a blockade, and would be more likely to continue economic sanctions. And NATO would be relying on the US’s involvement, and a Nord Stream shutdown would increase European reliance on American natural gas: “Gas pressure on EU countries is generally good for the US,” they said, “insofar as it allows them to sell LNG and highlight the power imbalance in the Western alliance.”

Others pointed out that neither Germany nor the wider EU have the appetite for direct confrontation like this. It would be “proportionate”, or even less than proportionate, as a response, one said, but “the EU likes rules, and they have an agreement with Russia over Kaliningrad”. Meanwhile, “it is abundantly clear that Germany has limits as to how far they are willing to push against Russia.”

As with all of these forecasts, the outcome is highly dependent on the progression of the war. “If the war continues at a status quo level I'd put the chances of a NATO/EU blockade at less than 1%,” said one. “The reason I'm at 4% is if there is a major escalation in the war or some massive level of atrocities that are deemed completely unacceptable.”

Overall, our forecasters think that the lights will stay on and the gas will most likely flow. But a shutdown scenario carries enough risks to remain an area of concern